Presentation of Contract Assets and Contract Liabilities in ASC 606

Analysis and examples of contract assets and liabilities under ASC 606, including balance sheet presentation and implementation effects

An important component of Accounting Standards Codification (ASC) 606 is guidance on the proper presentation of balance sheet items generated when an entity or its customer performs in a revenue-related contract. An entity performs by transferring goods or providing services to a customer, and a customer performs by paying consideration to an entity. When one of the two parties satisfies its obligation, the performance is reflected in the entity’s financial statements as a contract asset or contract liability.

Terminology: The terms “contract asset” and “contract liability” were created by ASC 606, but they describe well-known concepts. For example, a contract asset may also be referred to as progress payments to be billed, unbilled receivables, or unbilled revenue. A contract liability may be called deferred revenue, unearned revenue, or refund liability. The change in terminology simply reflects ASC 606’s revenue model, in which reclassification from a contract asset to a receivable is contingent on fulfilling performance obligations—not on invoicing a client. Nevertheless, entities are not required to use the terms “contract asset” and “contract liability” for presentation purposes (ASC 606-10-45-5), and many entities continue to use more familiar terms such as “deferred revenue” on the face of their financial statements (see Apple, Inc.’s 2019 balance sheet).

Recognition of Contract Assets and Liabilities

While similar to prior guidance for construction- and production-type contracts, the concept behind contract assets and contract liabilities contains some differences. Furthermore, under ASC 606, contract assets and contract liabilities may be recognized for all contract types.

A contract asset is an entity’s right to payment for goods and services already transferred to a customer if that right to payment is conditional on something other than the passage of time. For example, an entity will recognize a contract asset when it has fulfilled a contract obligation but must perform other obligations before being entitled to payment. In contrast, a receivable represents a right to payment that is unconditional, except for the passage of time. Because a receivable is not a contract asset, receivables must be presented separately from contract assets on the balance sheet (ASC 606-10-45-3).

A contract liability is an entity’s obligation to transfer goods or services to a customer (1) when the customer prepays consideration or (2) when the customer’s consideration is due for goods and services that the entity will yet provide (ASC 606-10-45-2)—whichever happens earlier.

Generally, contract assets and contract liabilities are based on past performance. Whether to record a contract asset or a contract liability depends on which party acted first. For example, when a customer prepays, the receiving entity records a contract liability—an obligation that must be fulfilled to “earn” the prepaid consideration. Once the entity performs by transferring goods or services to the customer, the entity can recognize revenue and adjust the liability downward. On the other hand, an entity could perform first by transferring goods or services to the customer, recognizing a contract asset and revenue for their work although they are not yet legally entitled to payment. Once the entity is legally entitled to payment, the entity can record a receivable and remove the contract asset from their books.

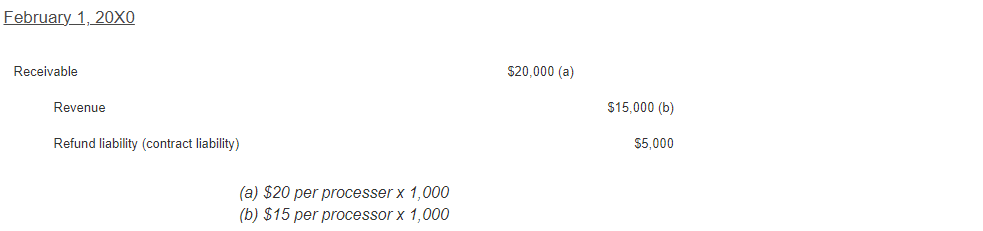

A possible exception to the past performance rule is a non-cancellable contract in which an entity records a contract liability before payment is received. For example, suppose an entity enters into a contract to deliver goods to a customer. The contract is non-cancellable, and the entity and customer agree upon a payment schedule. Assume the date for a customer’s prepayment arrives, but the customer fails to pay on time. The entity recognizes a receivable because non-cancellable contract payments are treated as guaranteed. In this situation, recognition of the receivable is based on the contract’s payment schedule rather than the timing of revenue recognition. In conjunction with the receivable, the entity will also recognize a contract liability to deliver goods. This liability will be reversed, and revenue will be recognized once the entity fulfills the performance obligation by delivering goods to the customer.

It should be noted, however, that there is a general resistance to “grossing up” the balance sheet in this manner. If a payment is due but has not been received, a company will likely consider other factors before recognizing a receivable (e.g., concerns about the relationship with the customer, enforceability of the arrangement, and collectability of the enforcement).

Receivables and contract assets are both subject to credit loss testing in accordance with ASC 326-20-35 (Financial Instruments—Credit Losses). When there is a difference between a receivable linked to a contract liability and the associated revenue later recognized, the refundable amount is treated as a credit loss (ASC 606-10-45-4). Credit losses on receivables or contract assets that originate from contracts with customers should be presented separately from other credit losses.

Common Contract Asset and Liability Presentation Questions

Issue 1: Multiple Performance Obligations

Some entities have questioned whether a single contract could have both a contract asset and a contract liability. For example, assume an entity has two performance obligations to fulfill in a contract. It has fulfilled the first and recognized a contract asset. Then the customer prepays for the unfulfilled second obligation, creating a contract liability. What is the proper treatment at this point?

ASC 606-10-45-1 states that an entity presents the contract as either a contract asset or a contract liability, net. Therefore, the Financial Accounting Standards Board (FASB) concluded that the remaining obligations should be presented on a net basis, either as a contract asset or a contract liability.

Some have argued that an entity should present contract assets and contract liabilities at the performance obligation level, meaning that both could be presented for a single contract. However, the guidance specifically outlines that contracts are presented on a net basis. Entities should also remember that receivables are presented separately from contract assets or contract liabilities and should not be included in a contract’s net asset or liability position.

Issue 2: Presentation of Two or More Contracts That Have Been Combined Under Step 1

When an entity and a customer enter into two or more contracts at or near the same time, the contracts are combined, and the entity accounts for them as a single contract. In these situations, should an entity determine a contract asset or contract liability (a) for each contract separately or (b) for one combined contract?

The purpose of contract combination is to identify a single unit of account (ASU 2014-09 BC72). The Boards’ intention to use a combined contract as the unit of account logically implies that the position of a contract asset or liability should be determined in aggregate. Therefore, the best way to present the rights and obligations of a combined contract is on a net basis (BC317).

Issue 3: Offsetting Other Balance Sheet Items Against the Contract Asset or Liability

An entity will have both a receivable and a contract liability on its balance sheet if the entity has recognized a receivable for completed performance obligations and has collected on previously billed receivables in advance of performance. ASC 606 requires that “an entity shall present any unconditional rights to consideration separately as a receivable.” Therefore, entities should not offset other balance sheet items, including receivables, against the contract asset or liability.

Issue 4: Netting the Sum of Contract Assets and Contract Liabilities

ASC 606 does not explicitly state whether an entity should present its total contract assets and total contract liabilities as separate line items or on a net basis. Considering the principles in ASC 210-20 and the guidance stating that an entity must disclose the balances of each balance sheet item separately, an entity should not combine total contract assets with total contract liabilities to present a net position; rather, both balances should be presented separately. However, this does not preclude an entity from netting on a customer-by-customer basis when a right to setoff exists in accordance with ASC 210-20.

Implementation Effects

Implementation of the guidance in ASC 606 regarding contract assets and liabilities will likely impact a company in three key ways. Implementation will require increased collaboration between departments, and companies may see changes in the audit and on the face of the balance sheet. For example, the IT department may need to modify systems to collect more or different types of data that will accompany financial statements in the disclosure section. Project managers may need to develop new measures for determining contract performance to support the timing of revenue recognition. In the audit, there will be more focus on management’s estimates and on internal controls, and auditors may spend more time reviewing disclosures and internal memos containing policy changes. In addition, some of the labels on the balance sheet may change from terms like “unbilled receivables” and “deferred revenue” to “contract assets” and “contract liabilities.” The balances of some accounts may also change (DHG).

Flowchart

Conclusion

ASC 606 introduces the terms “contract assets” and “contract liabilities,” though an entity may use different terms in its financial statements. A contract liability is recognized when a customer prepays consideration or owes prepayment to an entity according to the terms of a contract. A contract asset is recognized when an entity has satisfied a performance obligation but cannot recognize a receivable until other obligations are satisfied. While a contract asset represents a right to payment that is conditional on further performance, a receivable represents an unconditional right to payment. Both contract assets and receivables are tested for credit loss. For presentation purposes, contract assets and contract liabilities should be netted at the contract level and presented separately from each other in aggregate. Receivables should be presented separately from contract assets and contract liabilities.

Resources Consulted

- ASC 606-10-45-1 to 45-3, 55-284 to 55-294.

- ASU 2014-09: “Revenue from Contracts with Customers.” BC 341-347.

- EY, Financial Reporting Developments: “Revenue from Contracts with Customers.” January 2020. Section 10.1.

- KPMG, Issues in Depth: “Revenue from Contracts with Customers.” May 2016. Section 11.

- PwC, “Revenue from contracts with customers.” August 2019. Section 12.

- DHG, Views: “Revenue Recognition: It’s Not Just About Revenue.” October 2016.