Repurchase Agreements in ASC 606

ASC 606 provides guidance on accouting for repurchase agreements including forwards, call options, and put options; examples illustrate how the standard is applied to repurchase agreements.

Some contracts contain a repurchase agreement that obligates, or gives an entity the option, to repurchase the asset being sold, an asset that is substantially the same as that asset, or another asset of which the original asset sold is a component. To qualify as a repurchase agreement under the standard, the obligation or right should exist at contract inception. The accounting treatment depends on the type of repurchase agreement and the terms of the contract. Repurchase agreements that qualify as financial instruments are outside the scope of this article. The remainder of this article discusses how to account for repurchase agreements.

Types of Repurchase Agreements

Repurchase agreements come in three different forms:

- The entity’s obligation to repurchase the asset (forward).

- The entity’s right to repurchase the asset (call option).

- The customer’s right to require the entity to repurchase the asset (put option).

The accounting treatments for these repurchase agreements are discussed in the following sections.

Forwards and Call Options

Under a forward or a call option, the customer cannot direct the use of the asset to obtain all of its benefits, which indicates that the customer does not have control of the asset. Consequently, the entity does not recognize revenue when it transfers the asset, but continues to recognize the asset and records a liability on its books. Forwards and call options are accounted for based on whether the repurchase price is more or less than the original selling price:

- Lease Agreement – If the repurchase price is less than the original selling price, and the arrangement is not part of a sale-leaseback agreement, the repurchase agreement is accounted for as a lease (ASC 842-40).

- Financing Arrangement - If the repurchase price is more than or equal to the original selling price, or the arrangement is part of a sale-leaseback agreement, the repurchase agreement is accounted for as a financing arrangement.

In a financing arrangement, the entity continues to recognize the asset and records a liability for any amount of consideration received from the customer. Any amount that the entity will pay in excess of the original selling price is accounted for as interest expense or processing/holding costs. If the entity decides not to exercise the call option, it derecognizes both the liability and the asset and recognizes revenue equal to the consideration received.

When comparing the repurchase price to the original selling price, the entity should take into consideration the time value of money. The effects of the time value of money may be large enough to change the accounting from a financing arrangement to a lease agreement.

Toll Brothers, Inc. Correspondence With The SEC: Accounting for Repurchase Agreements

Toll Brothers, Inc. is a Fortune 500 company that is a leader in the United States for building luxury homes. Toll Brothers designs, builds, markets, and arranges the financing for residential and commercial properties throughout the nation. The Company responded to an inquiry from the SEC in April 2019 regarding the accounting used on land transactions that contain repurchase options. The response Toll Brothers provided is as follows, which is taken directly from the company’s comment letter to the SEC:

[Our] lot sale contracts with Builders generally include a repurchase option provision (a call option) that allows us to repurchase the lot from the Builder if a specified triggering event occurs (e.g., failure by the Builder to perform under the contract) or a proposed sale by the Builder to a third party. The repurchase price for a building lot is equal to 100% of the purchase price paid by the Builder for such lot and does not factor in the time value of money… Because the repurchase price of our option contracts does not factor in the time value of money, the repurchase price under the option is less than the original selling price. Accordingly, we concluded that we should account for these contracts as leases in accordance with ASC 840, “Leases.” (April 2019)

In the letter to the SEC, Toll Brothers evaluated the call options under the applicable standards, ASC 606-10-55-66 through 55-78, and reported that the contracts containing repurchase options (call options) are accounted for as leases in accordance with ASC 840 (updated standards reference ASC 842). Although the dollar amounts are the same, the guidance takes into consideration the time value of money. Factoring in the time value of money, the future repurchase price would be less than the original selling price, therefore, qualifying the call option as a lease agreement.

Put Options

Under a put option, the customer can require the entity to repurchase the asset by exercising the option. This option allows the customer to obtain all of the benefits of the asset, which indicates that the customer has control of the asset. Put options are accounted for in one of three ways based on (1) whether the repurchase price is more or less than the original selling price, (2) whether the repurchase price is more or less than the expected market value, and (3) whether the customer has a significant economic incentive to exercise the option:

- Lease Agreement – The repurchase agreement is accounted for as a lease (ASC 842-40) if the repurchase price is less than the original selling price, the arrangement is not part of a sale-leaseback agreement, and the customer has a significant economic incentive to exercise the option.

- Financing Arrangement - The repurchase agreement is accounted for as a financing arrangement if the repurchase price is more than or equal to the selling price and more than the expected market value of the asset.

- Sale of Product with Right of Return – The repurchase agreement is accounted for as a sale with right of return if the customer does not have a significant economic incentive to exercise the option and either (1) the repurchase price is less than the original selling price or (2) the repurchase price is more than or equal to the original selling price but less than or equal to the expected market value of the asset.

Generally, a customer has a significant economic incentive to exercise an option if the repurchase price is expected to exceed the market value of the good at the time of repurchase. Since this evaluation requires estimates, management will need to exercise good judgment in determining the factors that are included in this evaluation.

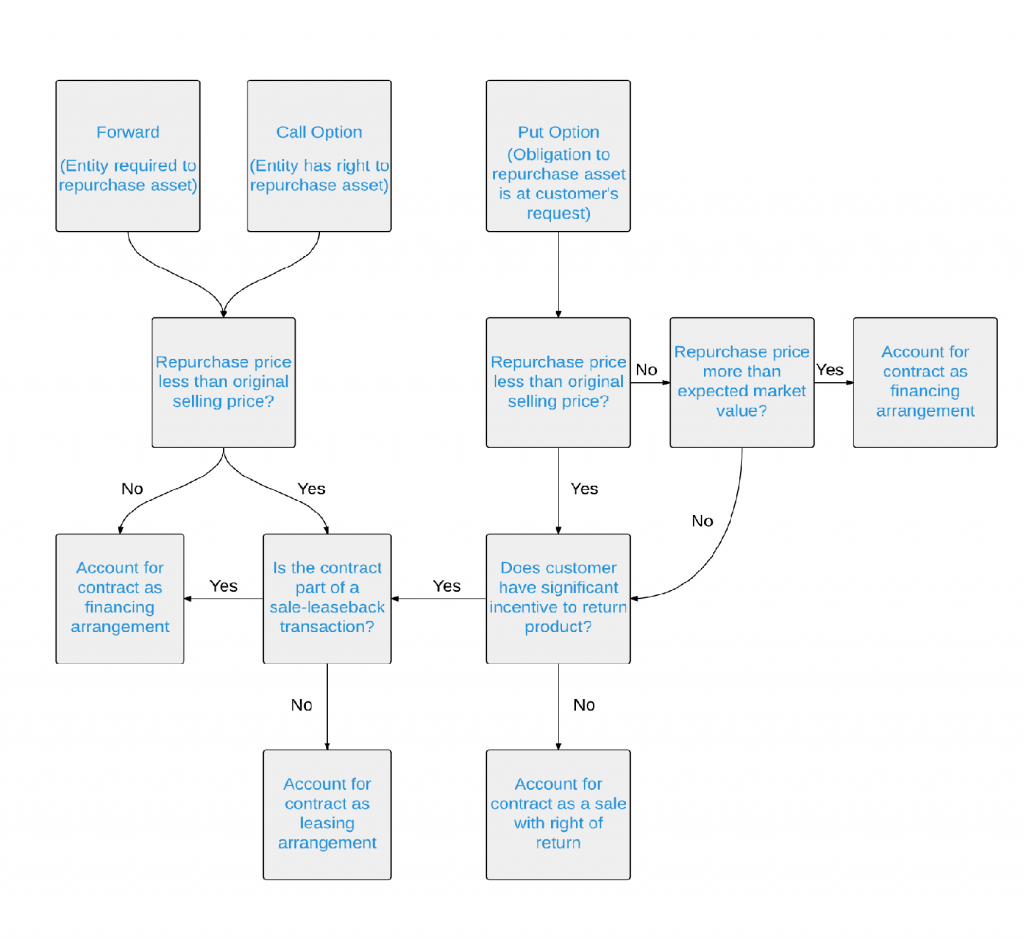

Financing arrangements receive the same accounting treatment as forwards and call options as described above. The accounting treatment for sales with rights of return is beyond the scope of this article but is addressed at length in the Rights of Return and Customer Acceptance. Similar to forwards and call options, if the customer decides not to exercise the put option, the entity derecognizes the liability and recognizes revenue equal to the consideration received. The entity should also take into consideration the time value of money when comparing the repurchase price with the selling price. The following flowchart provides a comprehensive review of the accounting process for repurchase agreements.

Example: Accounting for Repurchase Agreements

Scenario A: Accounting for Forwards or Call Options

An entity enters into a contract to sell an asset to a customer for $1,200. The contract provides an option for the entity to repurchase the asset in three years for a price of $1,300. The transaction is not part of a sale-leaseback arrangement. The company uses a 5 percent discount rate for similar transactions. Should this transaction be accounted for as a lease agreement or a financing arrangement?

This transaction should be accounted for as a lease under the guidance in ASC 840. The option is classified as a call option since the company has the right to exercise the option. At first glance, it appears that the repurchase price is more than the original selling price, but the present value of the repurchase price discounted at 5 percent for three years is $1,123. Since the repurchase price is lower than the original selling price, and the transaction is not part of a sale-leaseback arrangement, the transaction is a lease.

Scenario B: Accounting for a Put Option as a Financing Arrangement

An entity enters into a contract to sell an asset to a customer for $1,500. The contract provides an option for the customer to require the entity to repurchase the asset in three years for $1,600 (assume this price takes into account the time value of money). The transaction is not part of a sale-leaseback arrangement. The expected market value of the asset in three years is $1,400. Should this transaction be accounted for as a lease agreement, financing arrangement, or sale with right of return?

This transaction should be accounted for as a financing arrangement. The option is classified as a put option since the customer has the right to exercise the option. The repurchase price is more than the original price of the asset and the expected market value of the asset, making the transaction a financing arrangement (the customer is providing financing to the company). The company will recognize a liability of $1,500 for the consideration received from the customer. If the customer exercises the option in three years, the company records $100 ($1,600 - $1,500) of interest expense and reverses the liability. If, however, at the end of the three years the customer decides not to exercise the option, the company recognizes $1,500 of revenue and reverses the liability.

Scenario C: Accounting for a Put Option as a Sale with Right of Return

Assume the same facts as scenario B, except the expected market value of the asset in three years is $1,650. Under these circumstances, there is not a significant incentive to exercise the option because the customer can sell the asset for more in the market ($1,650) than it would receive from exercising the option ($1,600). In this case, the transaction is treated as a sale with a right of return.

Conclusion

Repurchase agreements are accounted for in a number of ways, depending on the type of repurchase agreement and the terms of the contract. Under forwards and call options, the repurchase price is compared to the original selling price to determine whether to account for the transaction as a lease or financing arrangement. Under put options, the repurchase price is compared to the original selling price as well as the expected market value of the asset at the date of repurchase to determine whether to account for the transaction as a lease, financing arrangement, or sale with right of return.

Resources Consulted

- ASC 606-10-55-66 to 55-78

- EY, Financial Reporting Developments: “Revenue from Contracts with Customers.” September 2021. Section 7.3.

- KPMG, Handbook: “Revenue Recognition.” December 2021. Section 7.5.50, Section 7.5.60, Section 7.5.70.

- PWC, “Revenue from Contracts with Customers.” February 2022. Section 8.7.