Contract Modifications Part II - Contract Modification Treatment

The prospective treatment method vs. the cumulative catch-up adjustment method of applying contract modification treatment under ASC 606.

Contract Modifications Part I introduced contract modifications and described the steps to determine whether a contract modification should be considered a separate contract. First, an entity determines whether a change to a contract qualifies as a contract modification. Second, the entity determines whether the change meets the requirements for treatment as a separate contract. A contract is considered separate when the change is comprised of the addition of distinct goods or services at a price comparable to their standalone selling prices. This article addresses proper accounting treatment for modifications that are not treated as separate contracts.

Step 3: Determine proper accounting treatment for contract modifications

If the contract modification is not considered a separate contract, the modification is combined with the original contract. There are two methods to account for these contract modifications. An entity should choose the method that most appropriately aligns with the facts and patterns of the modified contract. The accounting model for contract modifications depends on the nature of all remaining goods and services at the time of the modification (not just those added by the modification).

Method 1 – Prospective Treatment (Distinct Goods and Services)

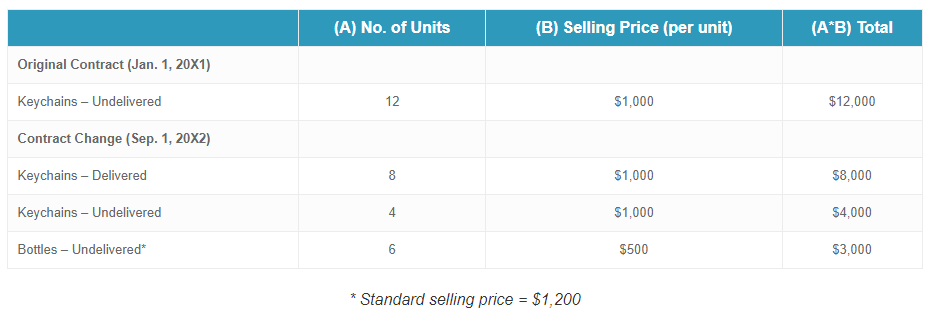

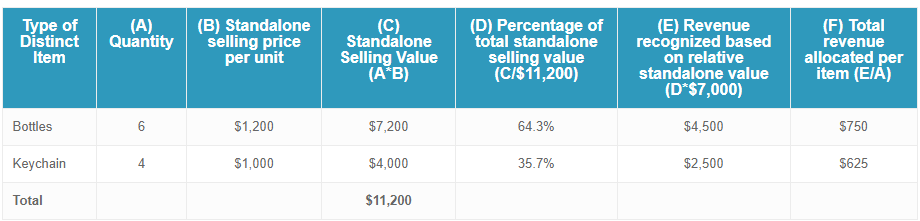

If the remaining goods and services are distinct from those in the original contract, but the modification does not meet the other separate contract criteria (i.e., the additional goods are not sold at a price comparable to their standalone values), the entity treats the original contract as terminated and accounts for both the original contract and the modifications together as a newly created contract (Accounting Standards Codification (ASC) 606-10-25-13). Revenue already recognized on the original contract is not adjusted. All remaining transactions are accounted for on a prospective basis: unrecognized consideration is allocated to the remaining performance obligations.

Method 2 – Cumulative Catch-up Adjustment (Non-Distinct Goods & Services)

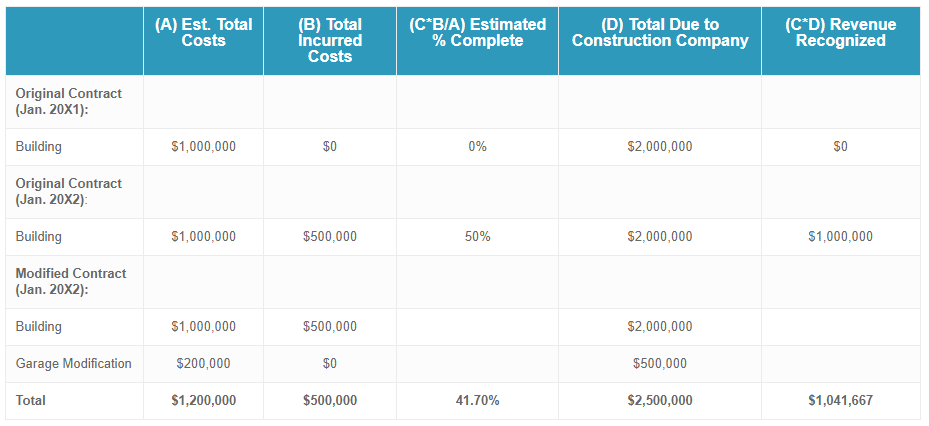

If the remaining goods and services are not distinct, the entity combines the increase or decrease of goods or services with the original contract’s promised goods or services to create a single performance obligation that is partially satisfied at the date of the modification. The entity adjusts revenue previously recognized to reflect the changes of the modification to the transaction price. This ensures that revenue recognized measures progress toward completion of the performance obligation (on a cumulative catch-up basis).

Comparison to Contract Modification in ASC 605

Guidance for contract modifications under ASC 605 varied between industries, but was most extensive for change orders and claims for construction- and production-type contracts (ASC 605-35). This shares some similarities with the guidance under ASC 606. As most other industries did not have as extensive authoritative 605 guidance, entities relied on guidance from accounting firms and followed their own, internally generated policies. Under ASC 606, entities will need to critically evaluate their longstanding practices and policies. This could lead to major changes in accounting policies (or few, if any, changes) depending on how closely aligned an entity’s accounting for contract modifications is to ASC 606.

It is unlikely that construction- and production-type industries will see major changes when accounting for changes to a contract. ASC 605-35 has similar requirements of additional, distinct promised goods and services at a comparable price in order for a change to be a separate contract. However, all entities will need to carefully examine modified contracts that were considered completed under ASC 605 because performance obligations associated with those modifications may be considered unsatisfied under ASC 606 (for more on this, see Contract Modifications – The Hindsight Expedient).

Conclusion

ASC 606 provides authoritative guidance to a subject that, in many industries, had none. Under ASC 605, many entities relied on firm guidance and other non-authoritative sources to develop accounting policies for contract modifications. The transition to 606 forces entities to review longstanding policies and practices to ensure they are in line with authoritative guidance.

If the goods or services remaining after a contract modification are distinct from those in the original contract, but are not provided at comparable standalone selling prices, the original contract is treated as terminated; the original contract’s remaining performance obligations and the modification are accounted for as one, single, partially-completed contract without any adjustments to revenue. If there are no distinct goods or services provided, the modification is combined with the original contract by adjusting revenue on a cumulative catch-up basis.

Companies are dealing with impracticalities of transition guidance pertaining to contract modifications. Some find it costly and overly difficult to retrospectively apply this guidance to all their contract modifications because they have numerous decades-long contracts with multiple modifications. The Financial Accounting Standards Board (FASB) has proposed a tentative practical expedient to help transition from ASC 605 to ASC 606. For more on the practical expedient, see Contract Modifications Part III– The Hindsight Expedient.

Resources Consulted

- ASC 606-10-25-10 to 25-13

- EY, Financial Reporting Developments: "Revenue from contracts with customers." October 2018. Section 3.4.

- FASB TRG Memo 24: "Contract Modifications." 26 January 2014.

- KPMG, Handbook: "Revenue Recognition." November 2018. Section 11.

- PWC, "Revenue from contracts with customers." September 2018. Section 2.9.